what food items are taxable in massachusetts

Although Massachusetts still levies a 625 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more. What food doesnt get taxed.

Everything You Need To Know About Restaurant Taxes

Vending machines which sell only food items with a sales price of.

. The exemption for food includes. Massachusetts has a higher state sales tax than 635 of states. Also certain items are taxable including carbonated water chewing gum seeds and plants to grow food prepared salads and salad bars cold sandwiches deli trays candy.

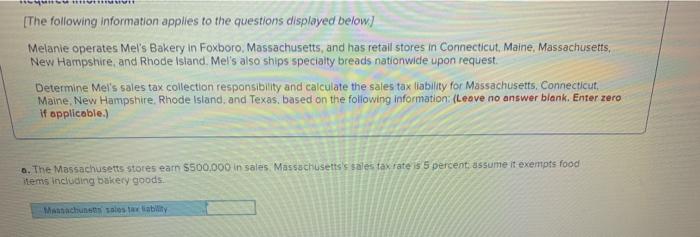

Massachusetts has a separate meals tax for prepared food. That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate. Here is a list of tax exempt food and food products unless sold under specific conditions.

Grocery items are generally tax exempt in Massachusetts. Heated foods salads and sandwiches and cheese and finger-food. Massachusetts has no special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Food must meet these. Solved Goods that are subject to sales tax in Massachusetts include physical property like furniture home. Massachusetts has one sales tax holidays during which certain items can be purchased sales-tax free.

Several examples of exceptions to this tax are. The following are not ordinarily considered restaurants. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. In the state of Massachusetts sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Industrial commissaries which make no retail sales.

Most food is exempt from sales tax. What Items Are Subject To Sales Tax In Massachusetts. Food clothing items under 175 admissions sales and most utilities and heating fuel are exempt from the.

This page describes the taxability of.

Meals Tax Helps Budget Gaps In Massachusetts Cities And Towns Masslive Com

How Do State And Local Sales Taxes Work Tax Policy Center

Ohio Sales Tax For Restaurants Sales Tax Helper

Solved The Following Information Applies To The Questions Chegg Com

Thai On The Fly Menu In Westford Massachusetts Usa

These Are The Unhealthiest Grocery Items You Can Buy In The United States According To Moneywise Masslive Com

Massachusetts 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Fresh Way Pizza Menu In Worcester Massachusetts Usa

Rare Massachusetts Tax Refund Raises Interesting Question About Surplus Revenue

Learn More About The Massachusetts State Tax Rate H R Block

Online Menu Of Scotties Famous Pizza Restaurant South Yarmouth Massachusetts 02664 Zmenu

Massachusetts Cottage Food Law Forrager

Washington Sales Tax For Restaurants Sales Tax Helper

The State S Sales Tax Holiday Is Here Our Consumer Columnist Has Tips For You Business Berkshireeagle Com

Massachusetts Income Tax Rate And Brackets 2019

Massachusetts Who Pays 6th Edition Itep